For Mining Corporations

Non-dilutive off-take solutions for gold, silver, platinum, copper and earth minerals. We coordinate buyer engagement, verifiers, logistics and escrow-managed settlement so you can focus on operations.

For Institutional Buyers

Access LBMA 99.99% bars (49s) with CIF/CIP delivery and independent pre-shipment verification. Doré allocations available on request (with refinery/assay workflow).

Delivery, Insurance & Controls

CIF/CIP to named destination, ICC(A) cargo insurance ≥110%, independent verifier reports, and escrow-managed payment waterfalls. We transact as a sale of goods, not investment advice.

How We Stand Out at IntelliWealth

Why Institutions Work With Intelliwealth

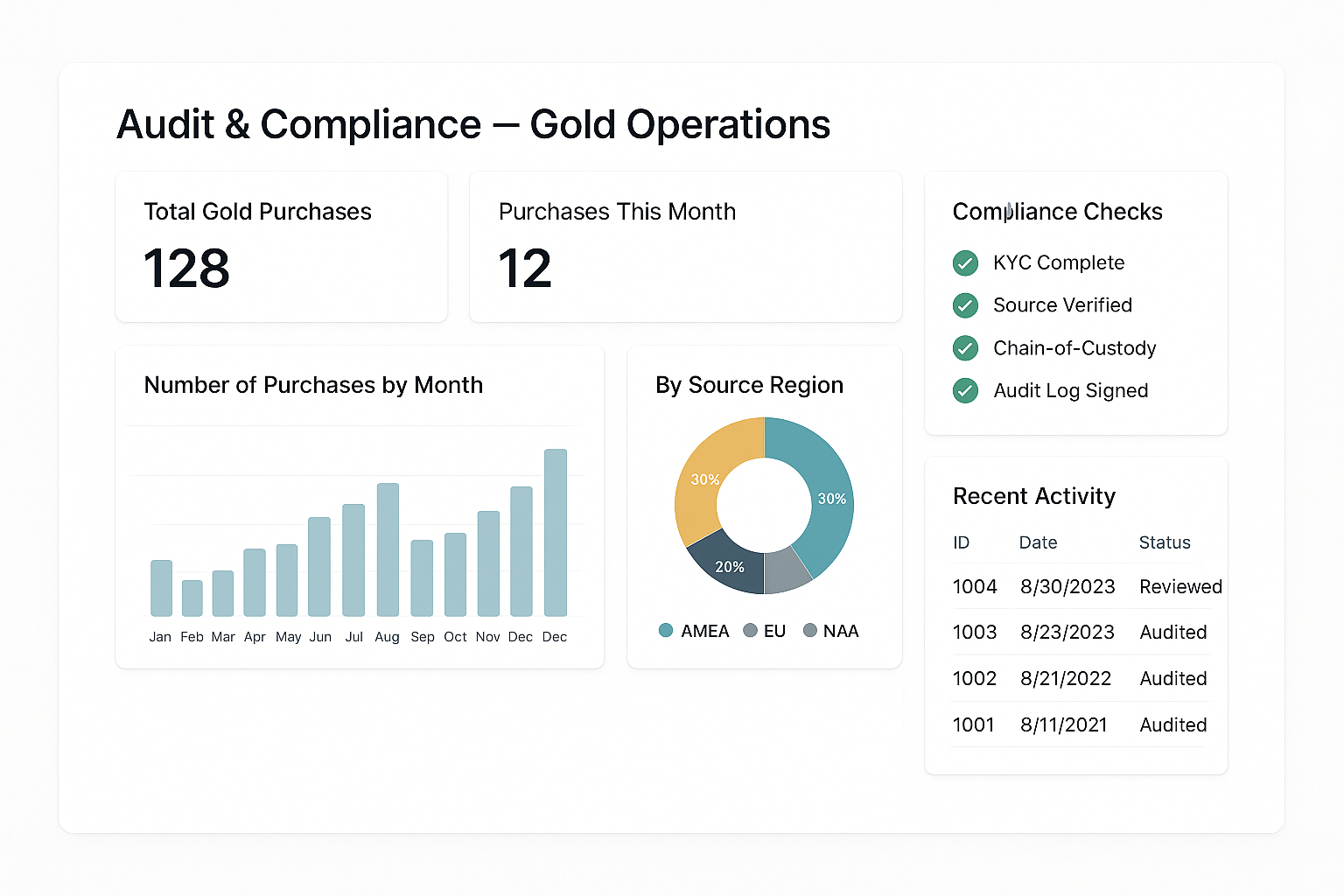

We broker physical metals transactions between professional buyers and regulated producers. Our role is operational: diligence coordination, verifier engagement, logistics (CIF/CIP), documentary packs, and escrow-managed settlement. We do not provide investment advice or operate a trading venue. All transactions are KYC/AML-screened and documented on a sale-of-goods basis.

How It Works

HOW A TYPICAL PURCHASE WORKS IN 3 Steps

Step 1: QUALIFICATION AND NDA

KYC/KYB and NDA → we share the document checklist, delivery options and verifier workflow.

Step 2: COMMERCIAL TERMS & CPs

Agree indicative discount (often 6–8% to spot, deal-specific), destination, CIF/CIP insurance and pre-shipment verification. Escrow instructions and payment waterfall are set.

Step 3: Delivery & Acceptance

Independent verifier report + serialised bar list; insured shipment to consignee; arrival inspection window and documentary acceptance.

Prepaid Forward & Delivery Windows

Purchase Pre-Paid Assets

For qualified buyers, we may coordinate prepaid forward structures with future delivery from producer output. Timelines are defined up-front with milestones, monthly reporting, and a single 6-month grace at buyer election. Settlement is via escrow with predefined waterfalls. Contact us for current availability and delivery windows (capacity currently up to 50,000 oz of gold).

Doré & Refinery Workflow

Solutions for your needs

Where buyers request Doré (not 99.99% pure), we coordinate refinery intake and assay with documentary continuity from mine to refinery to buyer’s account. Pricing and settlement reflect the agreed assay and recovery terms.

Prepaid Forward & Delivery Windows

New Mining Corporations

For qualified buyers, we coordinate prepaid forward sales from producer output with future delivery. Timelines are agreed up-front with milestones, monthly reporting and a single 6-month grace at buyer election. Settlement runs via escrow with predefined waterfalls; CIF/CIP logistics and insurance are arranged to the consignee’s named destination. Contact us for current availability and delivery windows (capacity currently up to 50,000 oz of gold).

Institutional-Grade Security and Compliance

We maintain a strict KYC/AML and sanctions framework and operate under a commercial sale-of-goods posture. Materials are shared one-to-one with professional counterparties under NDA. Payments are by bank transfer/regulated PSPs only; no cash accepted. Where required in the UK, financial promotions are approved by an FCA-authorised approver.

Metals We Source

All products are supplied under a sale-of-goods framework with CIF/CIP delivery and KYC/AML screening.

Trusted partners

Names & logos shown where we have permission or as illustrative placeholders; no endorsement implied.

Subscribe to our newsletters

contact us

For the information pack and next available delivery windows